Understanding What Amazon PPC Marketing Is and How It Works

ACoS, ROAS, CPO... What is the right KPI to measure performance marketing in Amazon Advertising in a meaningful and effective way? Is it just hard sales resulting from the PPC campaigns? What about the impressions? And how do the BSR (bestseller rank), CVR (conversion rate), and CTR (click-through rate) play a role? If you look at an advertising report from Amazon without much practice or previous experience and fatally even compare it directly with Google Ads or other advertising formats, you as an advertiser might draw the completely wrong conclusions and change your bidding and budget strategy in a diplomatically expressed, suboptimal way.

The most important key figures in Amazon Advertising

Before we delve deeper into bidding strategies, budget allocation and the interpretation of “recommendations” from Amazon employees, I would like to first briefly define the most important metrics and key figures and explain them in the Amazon context, because experience shows that they are either confused, misinterpreted or sometimes not understood at all.

ACoS

Whenever it comes to click-based or click-billed advertising on Amazon, the abbreviation “ACoS” quickly comes up. When written out in full, this stands for “Advertising Cost of Sales”, i.e. the share of costs for sales achieved with it. Or in a simple way to describe it: How much did I spend and how much did I earn. Example: I invested 100 Euros in Amazon Advertising and achieved 2,000 EUR sales from it. The ACoS, i.e. the share of advertising costs, is 5%.

ROAS

The abbreviation “ROAS“, which stands for “Return on Advertising Spend”, is more common and well known. It means exactly the same as the ACoS, but from a reciprocal perspective. Example, analogous to the ACoS: I invest 100 Euros in PPC marketing and make 2,000 Euros in sales. The ROAS here is 20 (or to 2,000 %), i.e. my advertising expenditure has practically “turned” into direct sales 20 times.

Impressions

The impressions (or “impressions”) tell you how often my ad(s) have been played by the user. So if a user enters the search word “Switch salad” at Amazon, on which I have previously placed one or more Sponsored Product Ads, the impressions tell me how often my ad(s) were actually “visible”.

CTR

The abbreviation CTR stands for “Click-Through-Rate” and tells you how often a user actually clicked on my ads after they were played. If my ad was displayed 2,000 times (impressions) on the keyword “salad bowl” and 50 clicks on these ads have taken place since then, my CTR is 2.5%.

CVR

The abbreviation “CVR” stands for “conversion rate”, i.e. how often the clicks on my ads are converted into real orders. Let’s stay with the example above: 2,000 impressions led to 50 clicks, which in turn led to 5 sales. So my conversion rate (based on the clicks on the ads) is 10%.

CPC

Quick and easy to explain: “CPC” stands for “Cost per Click” and describes the costs incurred for each individual click of a user on the advertisement. Since Amazon advertising, just like Google Ads, is a bidding process, the actual CPC almost always differs from the bidding on a particular keyword. Practically this means Advertiser 1 bids 0.50 EUR per click on the keyword “salad bowl”. Advertiser 2 offers 0.60 EUR per click on the small Amazon keyword. Advertiser 2 wins the auction due to the higher bid and his ad is played. If a user now clicks on it, Advertiser 2 is charged a CPC of 0.51 EUR. Although he has bid a maximum of 0.60 EUR, he is already played out for the next higher click price (+1 cent).

A Note on CPC

This is the current procedure. However, it is already rumored that there are considerations not to charge the 1 cent higher auction amount (i.e. 0.51 EUR as described above), but to charge the maximum bid in case of an auction profit. This is likely to fill Amazon’s advertising coffers again significantly and lead to a completely different bidding strategy for sellers, vendors and agencies in the future. Because up-to-date one could offer which one wants, because it will be accounted for always only the amount next higher around 1 cent.

Amazon Advertising Tips & Tricks

Now that we have clarified some metrics, we will go a little deeper into the matter, because in Amazon Performance Marketing there are some peculiarities to consider, which are often misunderstood or not understood at all. It should be noted that all the following advertising tips are to be understood as “Best Practice”. This means that these are not official guiding information from Amazon, but experiences of our agency from thousands of campaigns and their evaluations, which we have carried out for our customers.

Now that we have clarified some metrics, we will go a little deeper into the matter, because in Amazon Performance Marketing there are some peculiarities to consider, which are often misunderstood or not understood at all. It should be noted that all the following advertising tips are to be understood as “Best Practice”. This means that these are not official guiding information from Amazon, but experiences of our agency from thousands of campaigns and their evaluations, which we have carried out for our customers.

Amazon Advertising Tip 1: Win BuyBox faster

Suppose three merchants offer the same product on Amazon for a very similar price, and they all send the product to the Amazon logistics center to take advantage of Amazon Prime and take advantage of the FBA benefits. Whether and who wins the BuyBox now depends, among other things, on certain criteria regarding the merchant performance of each individual merchant (see Seller Central). In fact, an active advertising campaign on this same ASIN can lead to the BuyBox being won faster or even at all. In this respect, it makes sense to always run at least Sponsored Product Ads with automatic alignment.

Amazon Advertising Tip 2: PPC can influence purchase orders from vendors

With thousands of brands and manufacturers already participating in Amazon Marketplace, not every single vendors’ order (purchase order) is triggered individually but is in part determined algorithmically and executed automatically. An important lever for this is traffic on the product. Not necessarily “hard” sales or a good CVR is decisive, but how many users have looked at a product on Amazon. Targeted advertising campaigns can now lead to orders being placed more frequently or at all. This is particularly important for vendors, as they cannot force or somehow oblige Amazon to trigger orders. However, PPC campaigns can increase the attractiveness of their own products and thus the probability of orders.

Amazon Advertising tip 3: PPC has an (indirect) influence on the ranking

This is often misunderstood, so let me make it very clear once again: the mere fact that I place advertisements does not influence anything. But the effect of generating traffic and sales for a product does influence the organic ranking and thus the general visibility of my products. Please always remember: Amazon is a product search engine. The findability of the products is therefore essential, if and how much you sell. With PPC campaigns I can therefore not only directly provide better sales figures, but also indirectly provide better visibility, which in turn leads to more sales.

This is often misunderstood, so let me make it very clear once again: the mere fact that I place advertisements does not influence anything. But the effect of generating traffic and sales for a product does influence the organic ranking and thus the general visibility of my products. Please always remember: Amazon is a product search engine. The findability of the products is therefore essential, if and how much you sell. With PPC campaigns I can therefore not only directly provide better sales figures, but also indirectly provide better visibility, which in turn leads to more sales.

Amazon Advertising Tip 4: Pay attention to retail readiness

Before you start to invest budgets in Amazon ads, you should urgently “tide- up”, i.e. optimize your product data for relevance and the target group. High-quality product images, optimized titles, bullet points and backend keywords and a meaningful description are the basics. You should also make sure that especially products with good reviews (from 4 stars rating) are advertised, otherwise you will “burn” your advertising budget. More tips on retail readiness can also be found here: https://www.intomarkets.com/wiki/amazon-retail-readiness/

Amazon Advertising Tip 5: Ensure comparability

If you want to evaluate the success of your advertising campaigns on Amazon, you have to make sure that the conditions are halfway equal. If, for example, a month is significantly worse or better, this can be due to the weather or other temporary events. So it would be better not to compare July with August, but to use the same month from the previous year. Many other things should also remain stable in the comparison period. For example, a price change, or an update of the product data has a great influence on the impressions, CTR, and CVR of the campaigns. Campaign structure, bids, and accurately advertised products are other of many factors that can influence and dilute comparability. One recommendation at this point is to run the campaigns as long as possible (one calendar year) with as few changes as possible and thus compare them with the following or previous year. The more data you have, the better you can compare.

Amazon Advertising Tip 6: A low ACoS can cost a lot of profit

Now we come to a point that is often misinterpreted. If the ACoS is very low, it is often perceived as positive. After all, in relation to turnover, you spend little (or no) money on advertising. This is true, but it is a fallacy. Here is an example:

Campaign A runs at an ACoS of 15% and campaign B at 20%. Most now tend to rate Campaign A as better. Let’s look at the details:

- Campaign A costs 500.00 EUR per month and generates a turnover of 3,333.33 EUR.

- Campaign B costs 1,000.00 EUR per month and generates a turnover of 5,000.00 EUR

Here alone you can see that a higher ACoS does not have to be worse per se. However, it is now also crucial to consider what the contribution margin and margins of the products sold look like:

- Products advertised in Campaign A have a sales volume of EUR 50.00 and a contribution margin of EUR 30.00, leaving a margin of 40%. In terms of sales, this represents a profit of EUR 1,332.33. Deducting the advertising costs, a profit of 833.33 EUR remains.

- Products advertised in campaign B have a sales volume of 80.00 EUR and a contribution margin of 40.00 EUR, leaving a margin of 50%. In terms of sales, this amounts to a profit of EUR 2,500.00. After the deduction of the advertising costs, a profit of 1,500.00 EUR remains.

This means, therefore, that a higher ACoS may even be more profitable, taking into account total turnover and contribution margins. For this reason, campaigns should be analyzed and evaluated as granularly as possible according to products and their margins.

Amazon Advertising Tip 7: Calculate ACoS correctly for vendors

What is important when it comes to ACoS is that this value always refers to gross sales values, i.e. end-customer prices. For sellers who offer their products directly on the marketplace in their own name, this is also okay. From a vendor’s point of view, this is completely different and the actual ACoS is actually much higher. For a better understanding, here is an example:

- Dealer A is a seller and sells his products in his own name directly on Amazon. He spends 100 EUR on advertising and achieves a turnover of 2,000 EUR. His ACoS is therefore 5%.

- Dealer B is a vendor and does not sell his products directly but to Amazon. He also spends EUR 100 on advertising and also generates a turnover of EUR 2,000. However, his ACoS is 10%, because Amazon buys his products from him with a margin of 50%. This means that he has sold products to Amazon with a value of 1,000 EUR. This is HIS basis for calculating the ACoS, because he does not benefit from EUR 2,000 in sales revenue to the end customer.

Vendors must therefore always calculate the advertising cost turnover on the basis of their actual product sales to Amazon. This can quickly lead to disillusionment, as supposedly good ACoS values suddenly look completely different and the profitability of campaigns is called into question. However, the next Amazon Advertising tip is important.

Amazon Advertising Tip 8: Always look at all sales holistically

We have already considered that the ACoS can be very deceptive. In fact, the ACoS is generally a poor indicator of overall profitability, because, as we have also explained earlier, traffic and sales have an impact on organic reach. If you now reduce the advertising budget, this often also results in a decline in organic sales. Fatally, this can happen with a very long delay, i.e. a saving in the advertising budget has a positive effect in the short term. If the organic keyword rankings then fall in the medium term, this has a subsequent negative effect on total sales. It is therefore much better to always evaluate all sales from inorganic traffic (advertising) and organic traffic (rankings). This is also known as CPO, the “cost per order”. This means how high are the total costs per product sold. Here is another example:

- In month A, EUR 5,000 is invested in advertising, generating 300 direct sales worth EUR 30,000. The ACoS here is therefore 16.66%. However, a total of 600 products are sold, i.e. 300 units that do not result directly from advertising. The total sales for month A is therefore EUR 60,000. 600 products sold at 5,000 EUR advertising input makes a CPO of 8.33 EUR.

- In month B the advertising costs are reduced to EUR 2,000, resulting in 150 direct sales worth EUR 15,000. The ACoS here is therefore only 13.33%. However, only 220 products are sold in total, i.e. 70 units that do not result directly from advertising. Total sales for month B then amounted to EUR 22,000. 220 products sold at 2,000 EUR advertising input makes a CPO of 9.09 EUR.

This means that a reduction in the advertising budget or bids at keyword level can reduce the advertising cost share, but this also has a negative effect on organic sales. An apparently better ACoS then has the consequence that the CPO rises, i.e. the total cost per product sold may increase.

Amazon Advertising Tip 9: Critically evaluate Amazon recommendations

Vendors in particular tend to generally take Amazon’s recommendations as a set and follow them without restriction. Just recently, one of our clients received an optimization sheet for over 300 campaigns with thousands of keywords advertised daily, which included the following:

- For keywords with an ACoS of less than 15%, bids should be increased by a flat rate of 50%.

- For keywords with an ACoS of over 15%, bids should be reduced by a flat rate of 40%.

General rules without consideration of the strategies behind them are per se meaningless. The annoying thing here, however, was the lack of a database. Specifically, the blanket “optimization tips” were based on 1 to 2 clicks. This lacks any logic because every PPC campaign first needs time for the algorithms to react and learn. After 1 or 2 clicks, intervention is therefore absolutely not recommended, and achieved ACoS values cannot yet be regarded as final. Only after at least 10 or 20 clicks can you slowly see where click prices and conversions will level off. Therefore, please always critically examine such recommendations by Amazon employees themselves or together with the service provider.

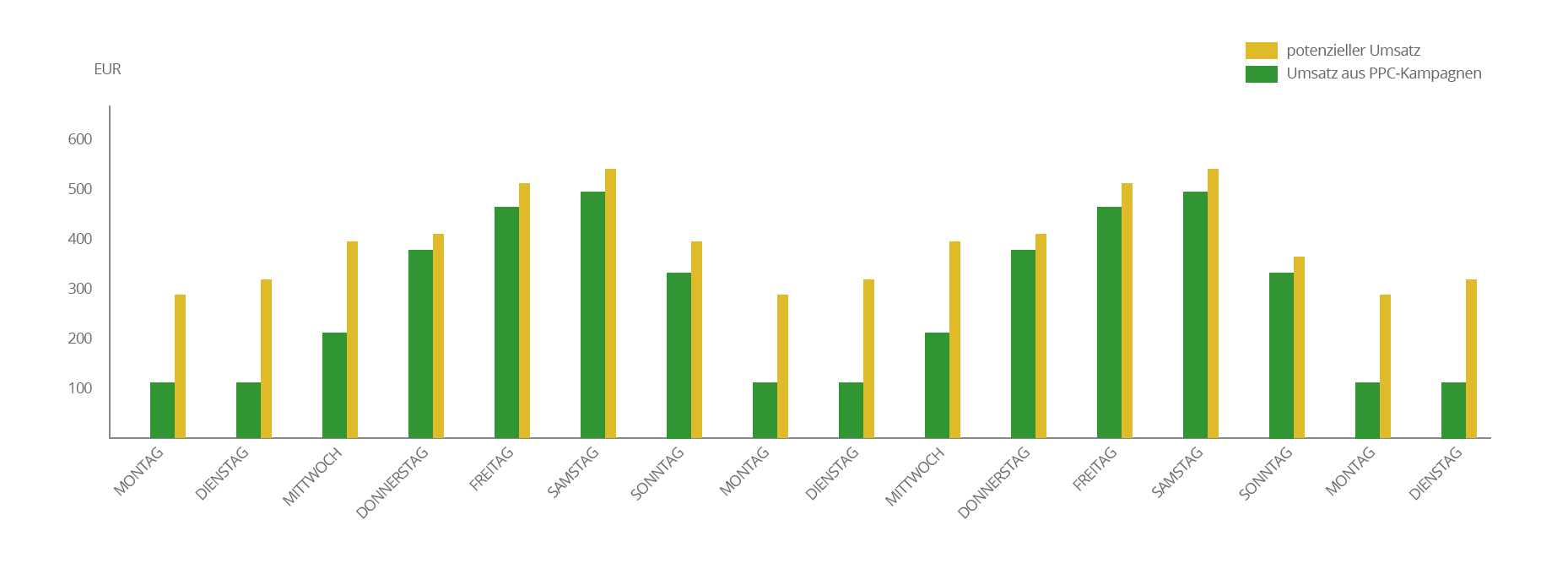

Amazon Advertising Tip 10: Allocate budgets correctly

Also, often typical for brands and manufacturers is a misguided budget planning and little or no flexibility in this respect. This means that fixed advertising budgets are set for the coming year without paying attention to possible profitability. We experience this time and again, that the budget is practically exhausted in the middle of each week and the campaigns are reduced in terms of bids. The annoying thing is that then 3-4 days hardly any turnover can be achieved, even if it had been highly profitable. Unfortunately, the budgets were set without considering economic goals.

Amazon is a fast-moving market with a lot of dynamics, which is sometimes very difficult to foresee despite extensive expertise and many years of experience. Although fixed budget limits can sell well within a company, they have little or nothing in common with the goal of maximizing sales or profits on Amazon. Instead of strict budget limits, companies should find more flexible solutions here. One way of doing this could be that the investment in Amazon Advertising can increase dynamically if a certain CPO is not exceeded. This would have the consequence that the overall profitability of the advertising campaigns is maintained, but potential sales and profits are not cut off by rigid limits.

Conclusion: ACoS is not everything – companies must learn to think holistically

Unfortunately, the easiest way is not always the best – a good example of this is the ACoS. A quickly displayed metric in the Amazon Advertising construct that can quickly lead to a wrong overall performance of PPC campaigns. There is no question that the ACoS is a good indicator to get a first, quick impression of the development of the advertising measures, but it is also only one of many. Viewed in isolation, a lower ACoS can even be economically “harmful”. Our urgent recommendation is to take a more holistic approach rather than just directly related costs. There is no question that this is much more difficult as a vendor because often it is not even possible to determine exactly how much the total order volume with Amazon reference has looked like in a given period, let alone how it will develop. Nevertheless, it is important to always look at advertising measures in their entire context, even if measurability is sometimes somewhat difficult. And especially with Amazon, the following apply once again in this context: If you don’t advertise, you die.

Leave A Comment